Newsletter #20: How to keep up with Middle East sovereign funds?

Shifting sands 🏜️

How to keep up with Middle East sovereign funds?

Evidently, they’re not that easy to keep up with — which can be troublesome for capital hungry GPs when fundraising is already as difficult as it is.

The shifts in mandate can be surprisingly swift and dramatic — like how Mubadala and BlackRock recently called off their Asian private credit collaboration just 2 years after announcing it.

The partnership has deployed only a limited amount of capital. Originating deals in China is proving difficult given the mid-teens return profile it’s targeting, said the people.

The head of private credit in Indonesia, Christopher Ganis, left in the early days of the collaboration for sovereign wealth fund Indonesia Investment Authority. That’s made it difficult for deal origination in the country, the people added. (Source: Bloomberg)

There are a few factors at play here.

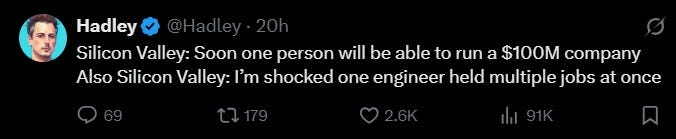

Global LPs (Middle East sovereigns included) are reducing their funds exposure — particularly in private equity and venture capital. The preference today leans towards: i) Private credit for lower risk and more predictable returns; and ii) Direct dealmaking, where they can bring that capability in-house while saving on fees and carry.

Over the past year, Middle East SWFs, notably Abu Dhabi Investment Authority (ADIA) and Mubadala have either laid off/downsized their funds teams or paused fund deployments.

The formation of Lunate involving a 3 entity roll-up totaling $110 billion in AUM — ADQ, ADG and Chimera Investment — also inevitably led to team overlaps and departures.

In Saudi Arabia, PIF has also grown increasingly selective over its fund and direct deployments, especially as volatile oil prices and lagging performance of its giga projects weigh on the minds of allocators.

One would imagine that a shift towards more direct investing by MENA LPs would lead to larger overseas offices to do the hands-on work. But one MENA LP told me that it may not necessarily be the case, at least not as quickly as one might think.

“A lot of the sovereigns in this region have this mindset that because people want to raise money, they will come here (Middle East) instead of having to fly there or have a team there. So I think it's going to happen, but it'll probably be slower than one would expect,” said the UAE-based LP in confidence.

This will be an interesting development to follow.

MENA LPs are on the hunt for alpha and diversification, Seviora’s Abu Dhabi chief, Sadiq Hussain told me in an interview this week.

You can certainly find that in China, India and Southeast Asia, but these are high growth, high risk and highly fragmented markets, where investors actively fly in and out of multiple countries + have boots on the ground, not out of choice but of necessity.

In some sense, perhaps it’s no wonder that the BlackRock-Mubadala Asia private credit partnership fell apart. But one shouldn’t be surprised to find a long line of global fund managers eagerly waiting to take their place…

ICYMI:

Saudi Arabia’s Wealth Fund Gets Boost From Investment Activities (Bloomberg)

PIF embraces ‘precision finance’ with diversified debt strategy, says Global SWF (Arab News)

Middle East LPs want diversification: Seviora’s Sadiq Hussain (Kristie Neo’s Substack)

The Waning Ambitions of China’s $1.3 Trillion Fund Giant (Bloomberg)

Interesting reads 🤓

Danantara's debut loan seen as market test for future global debt, bonds (DealStreetAsia)

Peak XV Partners should win the record outcome test with Pine Labs (Morning Context)

PE/VC fundamentals in Asia intact despite diminished risk appetite (DealStreetAsia)

A new Vietnamese food delivery platform tries to challenge Grab & Shopee (Momentum Works)

Indonesia breaks ground on $5.9 bn CATL-backed battery venture (Nikkei Asia)

Chip-Design Firm SkyeChip Is Close to a Malaysian IPO, CEO Says (Bloomberg)

Ninja Becomes Unicorn in Saudi After Riyad Capital-Led Funding Round (Bloomberg)

Mexican Fintech Klar Raises $190 Million at $800 Million Valuation (Bloomberg)

Abu Dhabi’s ADQ eyes stake in seed firm (Semafor)

Warner Music, Bain Capital launch $1.2 billion venture to buy music catalogs (Reuters)