Middle East LPs want diversification: Seviora's Sadiq Hussain

It's no longer just a need but a must, says the Abu Dhabi-based executive

It’s a tricky time to be a capital allocator.

The need for alpha hasn’t diminished — in fact it’s more in demand than ever before. Yet the opportunities are slim. Global PE liquidity and exits remain challenged, US tariffs have delayed dealmaking, geopolitical volatilities continue to persist globally.

For Middle Eastern limited partners (LPs), which have historically maintained significant exposure to the US/Europe and private equity (PE), this has only made the case for diversification stronger.

“The word diversification is not just a need, it's a must…They (Middle East LPs) are direly seeking that diversification play,” said Sadiq Hussain, who heads Seviora Group’s Middle East office in Abu Dhabi.

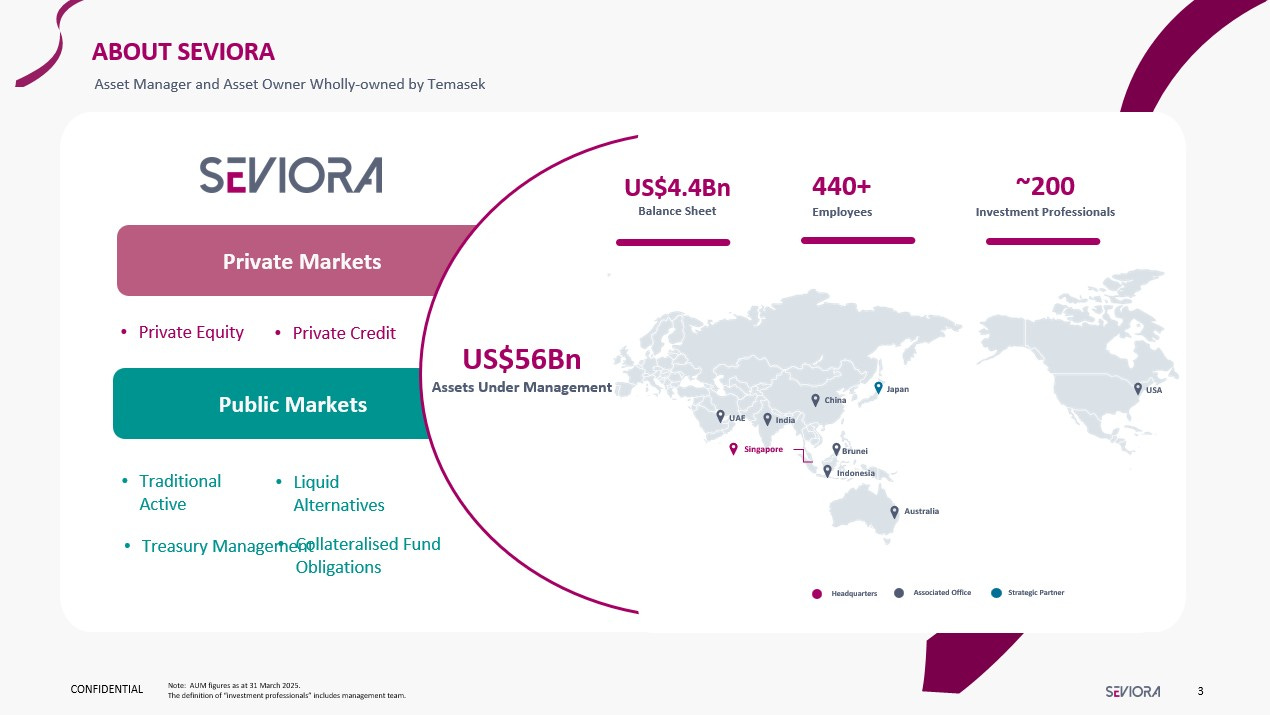

The Temasek-owned investment firm opened its first office in the UAE in March, marking its foray into the Middle East. It oversees $56 billion in assets under management (AUM) across 5 entities in active and alternative strategies — Azalea Investment Management, Fullerton Fund Management, Innoven Capital, SeaTown and Seviora Capital.

Asian Private Credit (SeaTown)

SeaTown Private Credit Fund II is $1.3 billion

Focuses on larger Asian corporates with loan requirements of $50-150 million or 5-15% of fund size

Invested over $3 billion across 45 loans to date

Asian Venture Debt (InnoVen)

Focused on early-stage start-ups to late-stage high growth companies

Invests in India, China, Southeast Asia

Provided $1.7b of venture debt to >400 startups in Asia, out of which >50 became unicorns. These startups raised a total of $54b in equity funding

Hussain declined to comment if Seviora raised money from the Middle East. However, he shared that the chief purpose of the Abu Dhabi office is to build relationships with Middle East LPs. It has no immediate plans to deploy in the MENA market.

Asia is still a new market for Middle East investors, with most LPs still at the very early stages of learning and exploring the market.

This has been growing steadily as the likes of Qatar Investment Authority (QIA), Abu Dhabi Investment Authority (ADIA) and Oman Investment Authority (OIA) open offices across China and Southeast Asia, while selectively writing cheques into funds or directly into the region.

According to Hussain, LP interest has been high in asset classes like Asian private credit, which remains highly underpenetrated compared to global benchmarks.

APAC private credit amounts to $99 billion in AUM but account for only 6.6% of global private credit AUM, according to Preqin. At the same time, APAC is expected to account for a third of global GDP by 2030, underscoring plenty of room for growth.

While the risk levels are admittedly higher in Asia, the enhanced yields of between 300 to 500 basis points positions Asia as a relatively attractive option, compared to the high single digit to 11% IRR yields in US and Europe.

Asian GPs have picked up on this, leading to a rise in new Asian private credit funds in recent times, such as Granite Asia, Synergy Capital, Ekuinas and Tikehau-Kay Hian Asia Private Credit Fund.

Seviora too has doubled down on private credit, with one of its investment firms SeaTown picking up a minority stake in Hong Kong’s ADM Capital last year.

But as MENA LPs are quickly beginning to learn, not all Asian markets are equal in scale and opportunity, whether it’s China, India or Southeast Asia. While a potentially weaker US dollar may eventually support a medium term case for emerging markets, entering Asia still requires a calibrated and balanced approach.

“Getting access into India and Southeast Asia is not easy. Access to dealflow is extremely difficult…These are relatively small markets compared to developed markets. You also need those expertise and relationships for them to really go into these markets with confidence and comfort,” explained Hussain on a video call.

However, he asserted that Seviora’s long track record in Asia and on-ground presence in Singapore, India, China and Indonesia, allows the firm to meet MENA’s needs for smart diversification.

Seviora’s interview transcript

This interview was held with Sadiq Hussain, Senior Executive Officer, Seviora Middle East.

The transcript has been edited for brevity and clarity.

Based on your conversations with sovereign LPs and family offices in the Middle East, what have been some of your takeaways in your conversations with them? What are they looking for as LPs and potential co-investment partners?