Interesting reads this week! #5

Cendana Capital on the future of seed VCs; TechCrunch is acquired! 🥲

“Does the world really need another seed VC?”: Cendana Capital 💵

Yes, mouthing those words was none other than Cendana Capital founder, Michael Kim, one of Silicon Valley’s most successful fund-of-fund (FoF) investors.

It’s a purely existential question to dare entertain, considering that this is what Cendana’s entire thesis was built upon — to invest in the world’s top pre-seed/seed and emerging fund managers.

Cendana just closed its Fund VI at $600 million earlier this week which will see the investor double down on sub-$100 million pre-seed and seed VCs. The average fund size of Cendana’s portfolio is $55 million and it’s core commitment has been $15 million, writes Kim.

Cendana is performing remarkably well. On average, Cendana has secured a net return of between 3-5x for all its funds, which has drawn in the likes of UTIMCO, Cambridge Associates and two new public pension funds.

But what’s still not quite understood is how AI might radically transform startups and the entire shape of the VC industry, shared Kim on a podcast with TechCrunch and StrictlyVC.

If the AI native startups of tomorrow are going to be built on way fewer staff while generating billions in dollars of revenue, why would any of them need to raise much seed capital, if at all?

“It's a great question, because we think about that. We think about — does the world need another venture fund, another seed fund? Can't these companies scale without capital or a lot less capital? We're asking that ourselves every day. We're asking that to our fund managers every day.

The real answer is that it is expensive to hire developers and the factory treadmill of people on the factory line. You go out and raise capital, hit a few metrics, and then you raise your next round, and you rinse and repeat. I think that is seriously under question now.

Venture investors, including LPs, really need to think through how they want to deploy capital in this chaos.” — Michael Kim, founder, Cendana Capital (Source: StrictlyVC Download)

In other words, the VC industry itself could be on the cusp of a pretty dramatic upheaval.

The LPs and GPs of today (seed and otherwise) will have to think very lucidly about the capital needs for the biggest startups of tomorrow and allocate accordingly. The future of startups will likely be one person and 10,000 GPUs, shared OpenAI’s Sam Altman recently.

So it isn’t just about about enterprise SaaS startups getting wiped out by AI. Even fund managers can be replaced by AI agents now!

(See tweet below.)

AI yay or nay? I’d love to hear what you think.

TechCrunch is sold to media investor Regent 🥲

I was having a conversation with a Dubai founder yesterday about TechCrunch and the sentiment was that “they may not even by around by the end of this year”. None of us were expecting this piece of news to break overnight…

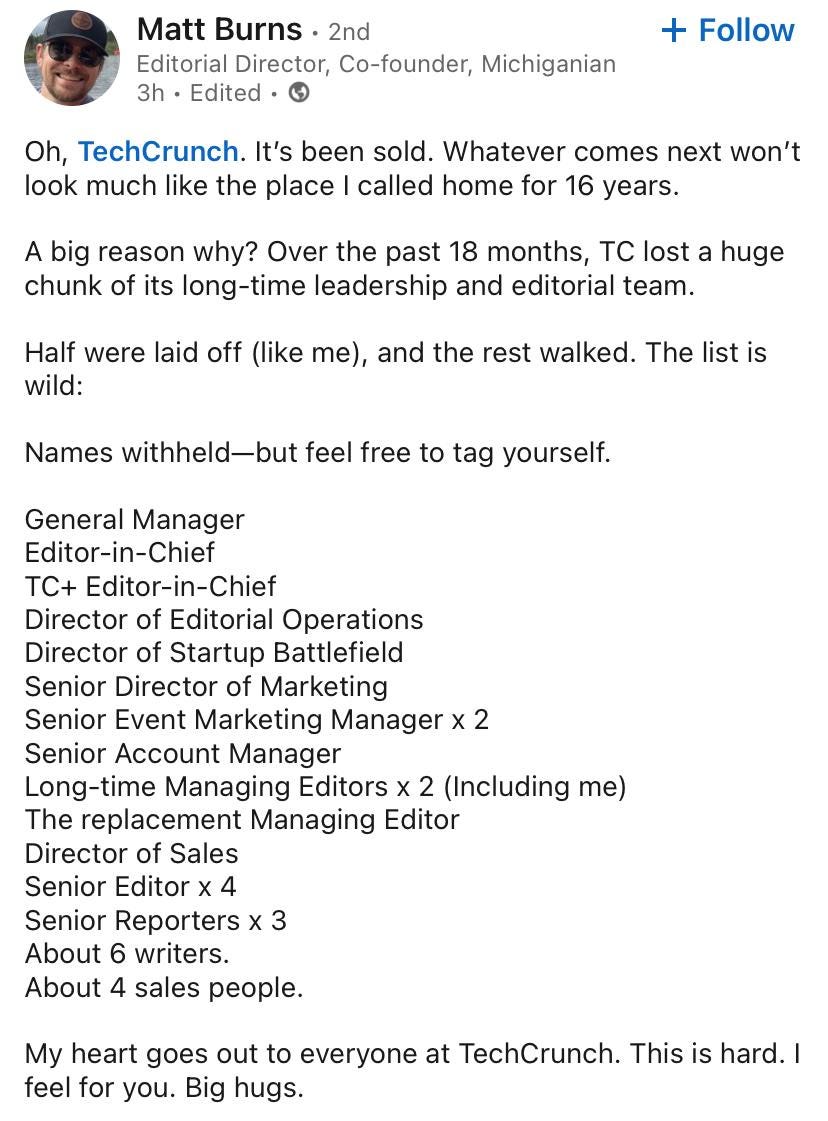

Since then, some ex-TechCrunchers have taken to social media to express their dismay.

It’s hard not to get personal when it comes to tech journalism. I do think we are entering a different era.

The problem is that I often get founders and investors sharing how sad and sorry they are about the decline of independent tech reporting, but so few are willing to pay for even a basic subscription!

Forget this baby Substack of mine, even in DealStreetAsia I had countless people badgering me (and usually the same folks) again and again for free PDFs…for years.

The value of information has become so cheap today that I don’t think people mind trading independent news for penny savings. Ultimately I think this comes at the cost to the entire tech ecosystem.

I have plenty to say about journalists too. We need to be way more innovative, way more entrepreneurial, and stop carrying this misguided sense of entitlement everywhere we go. Anyway, that’s enough online ranting for now. It’s back to work!

In the meantime if you have any feedback or ideas on how to improve this, do leave a comment! I’d love to hear from you :)

Other reads:

Saudi Fund Broadens Quest for Cash to Meet MBS’ Spending Goals (Bloomberg)

End of ‘blank cheque’ era for outside consultants in Saudi Arabia (Financial Times)

How a Chinese giant is disrupting Saudi Arabia’s food delivery (Rest of the World)

Confirmed: Google buys Wiz for $32B to beef up in cloud security (TechCrunch)

The LP View: SE Asia’s secondary market may take time to pick up, says StepStone (DealStreetAsia)

GoTo Financial may be spun off in potential Grab-GoTo merger (DealStreetAsia)

Indonesia's Fore Coffee files prospectus for $23m IPO (DealStreetAsia)

Dubai Land Department launches pilot phase of Real Estate Tokenization Project (Economy Middle East)