Interesting reads this week! #3

Will AI wipe out SEAsia/MENA’s SaaS startups? Groq's KSA ambitions, SEAsia startups turn profitable

Will AI wipe out SEAsia & MENA’s SaaS startups?

What is AI going to do to an entire generation of SaaS startups in Southeast Asia and MENA? Some of you here are VCs and investors from these regions, and I’d really love to know.

I had a conversation this week with a Dubai-based founder who is building an AI-native startup in real estate. In his words, investors “didn’t seem to understand" why he was raising funds for himself and his co-founders (who are all technologists) instead of hiring a large team. Bewildering…

I don’t even know if Southeast Asia and MENA VCs have even factored the massive value destruction that will inevitably take place once: i) A new generation of AI-native/agentic startups arrive on the scene; ii) The current generation of SaaS startups fail to incorporate AI and structure their ops quickly enough…

Ed Sim said it really well in his tweet:

Will the app stack of future just be a lakehouse where lots of smaller app databases just feed it and then agents and apps built on top?

Existing VCs have to juggle two competing thoughts - how do my existing portfolio not get destroyed by AI Native startups while at the same time meeting and funding that fresh-eyed new startup coming to kill their portfolio

These aren't either/or choices as not all will go away and not all AI-native startups will succeed, but point is you have to have fear on the one hand and completely remove that to believe in the future and invest now.

Ironically, I would imagine that what might end up slowing AI adoption would be the fact that labour in emerging markets (particularly here in the Middle East) is as cheap as it is. Of course the applications of this could vary depending on sector and market, and where that source of funding is coming from — private versus public.

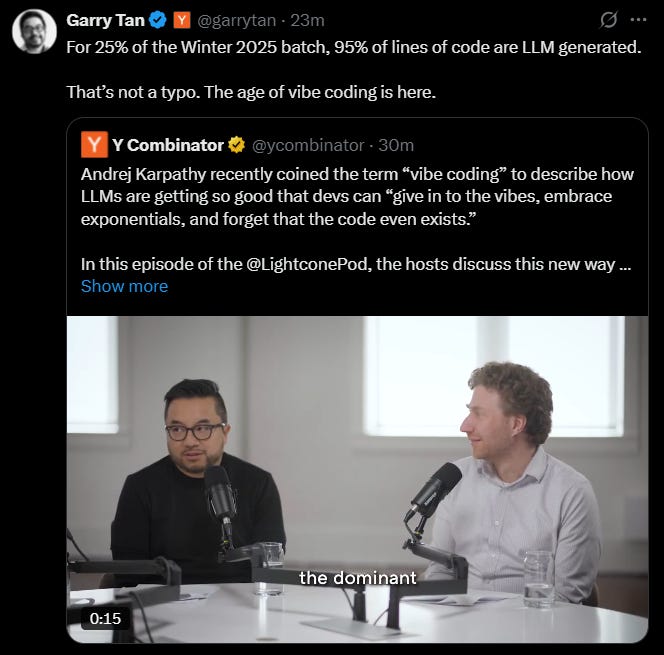

In the meantime, Silicon Valley techies are going through a major crisis discovering they can be outcoded by an LLM. High-level coding is now accessible to coders with zero experience. The pace at which AI native startups are hitting PMF and speed-to-revenue is already hitting records, writes Square Peg Capital.

At Y Combinator’s Winter 2025 batch, 25% of them already had 95% of their lines of code LLM generated. These LLMs are getting so good that apparently developers can “give in to the vibes, embrace exponentials, and forget that the code even exists.” A term they call “vibe coding”. Yeah, that’s a real thing.

Your thoughts?

Groq’s mega AI chip deal in Saudi Arabia 💵

According to a recent exchange between Chamath Palihapitiya and Groq, the AI inference chipmaker recently delivered 19,000 of their chips to Saudi Arabia. I’m guessing it had something to do with this $1.5 billion investment from KSA announced at LEAP Conference just a few weeks ago.

Groq’s advances into KSA aren’t new. Just last year, the Nvidia competitor struck a partnership with Aramco Digital to build the world’s largest AI inferencing data centre. The US chipmaker also closed a $640m Series D at $2.8b valuation led by BlackRock Private Equity Partners last year.

The facility will use Groq’s chips to perform high-speed AI processing, a key capability for technologies such as self-driving cars and national security applications that need almost instantaneous data processing to function efficiently. (Source: AGBI)

I was pretty surprised at how large this Dammam data centre was going to be. GroqCloud will be made available to 4 billion people adjacent to Saudi Arabia into 160 different countries across EMEA and South Asia markets.

This excerpt below was taken from 43:30 onwards:

Jonathan: Sonny, you just delivered about 19,000 of our chips to Saudi Arabia —

Chamath: How are you guys allowed to export to KSA? Maybe start there, right? And why KSA?

Sonny: Yeah, well, there's a couple pieces. But I think what really helps us is that you know, one, we have technology that's made in the US. Two, we have a cloud that we operate in conjunction with our partners. I would say the KSA is very particularly important if you look at it from a region is greater than 4 billion people within 15,000 miles if you draw a circle, somewhere inside Saudi Arabia. And for us, you know, they also have a strategic access to power, right? They have a lot of access power and space, so they can build data centers, they can power those data centers, and they have good connectivity to almost 4 billion people from that place. And so we're excited. That cluster is one we're very proud of.Chamath: Okay, but are you actually seeing like American companies serve out of Saudi Arabia? Or like those inference tokens. Are folks like copacetic about it? Or do they not even care?

Sonny: Worldwide, they don't care. I think as of today, we're serving out of 160 countries in that data center. We serve folks in 160 different countries.

Chamath: So speak to the power for a second, how easy or hard is it to get access? If you need to pull 250 extra megawatts?

Sonny: …Inside the kingdom, they have built a lot of power infrastructure, building off their gas energy reserves and they have built that for peak oil and peak oil never came. That’s good thing. What's happened is that infrastructure can be reappropriated to other uses. And a straightforward one to re-appropriate to, especially when you have a lot of land, is data centers. So I think from that perspective, Saudi Arabia is in a very special spot to be able to build up more power.

Chamath: So you’re saying if I need 250 megawatts and it kind of turns the next day?

Sonny: Not the next day. But yeah, conceptually.

SEAsia’s OSOME and J&T Express turn profitable, Sea Group too 🎉

There’s been an endless ton of layoff and corporate scandal stories in Southeast Asia, but shall we celebrate a couple of wins at least? The flipside to this downcycle is that we’re beginning to see some startups turn profitable (at last!)

NYSE-listed Sea Group closed its second consecutive year of full annual profits with all three of its businesses — gaming, e-commerce, fintech — hitting positive EBITDA. Do note however that it is gross profits for the former, and adjusted EBITDA for the latter.

J&T Express achieved first-ever annual profit in 2024 (TechinAsia)

OSOME turned profitable in Q4 (See image far below)

Created with TradingView

Other reads:

Peak XV’s inescapable transition (The Morning Context)

Private equity industry shrinks for the first time in decades (Financial Times)

AI copyright wars need a market solution (Financial Times)

El Salvador’s wild crypto experiment ends in failure (The Economist)

Sea shares jump after it makes headway in fight with Alibaba (Bloomberg)

Singapore semicon companies, including startups, can tap new S$500 million national fab facility by 2027 (Business Times)

Singapore’s ‘30 by 30’ food security goal currently under review, confirms government (Eco-business)

Dubai’s expat influx dents plush pay packages and lifestyles (Bloomberg)