What is Dubai's use case for tokenising real estate exactly?

The answers aren't so clear or straightforward 🤔

25.5.2025. That was the historic “once in a century” date picked by the Dubai Land Department (DLD) to launch the city’s first token trade of a land title on a blockchain.

To explain the significance of this, a little context is needed.

Land is probably one of the oldest asset classes in the world. Over the years, land titles have been traded manually in the form of paper certificates or in digitised formats via a government-backed e-registry.

What Dubai has done wasn’t simply place these land titles on a public blockchain. (Ripple Labs’s XRP Ledger to be specific.) They’re also “fractionalising” it — cutting them into tiny little blocks so they can be bought and sold at a lower price point, enabling real estate ownership for many more people.

What this looks like in effect is commonfolk like you and I can now invest a fraction of a fancy premium Business Bay condo for as low as AED 2,000 (US$545) a pop. The sales pitch? Property ownership should be an accessible right to anyone and everyone, especially international investors, who Dubai is appealing to here.

The general consensus is that a project like this would have only been possible in the United Arab Emirates (UAE), a country where government bureaucrats are highly zealous in placing themselves at the forefront of technological innovation.

While Hong Kong and Singapore regulators are still going back and forth on digital contracts, crypto adoption and licensing, Dubai is already launching live tokenised real estate products to the public. It’s a world first.

But it’s also where the ball stops rolling.

This sounds great, but why exactly is Dubai doing this?

Are they fractionalising real estate to resolve an illiquidity issue? Or are they doing this to help temper Dubai’s skyrocketing home prices?

As it turns out, it doesn’t seem to be the case for either.

Reality check #1: Dubai real estate is both liquid and affordable 💵

The research data shows that an overwhelming majority of Dubai’s real estate transactions are typically paid in cash and not mortgage, suggesting that the market doesn’t actually suffer an illiquidity issue.

According to Knight Frank, 86% of all Dubai real estate transactions were completed in cash in 2024.

While casual observers have often believed this to be driven by an influx of new ultra rich immigrants snapping up new homes, the reality is a little more nuanced.

Knight Frank’s head of MENA research, Faisal Durrani explained that because the majority (~70%) of Dubai’s real estate transactions are off-plan projects — or homes which are yet to be built — cash is the only available medium of transaction.

“When you're buying something off-plan or pre-construction in Dubai, you usually have to purchase it with a 20% cash deposit. You cannot get mortgages on an off-plan product until a certain construction milestone has been reached or until the property is completed…So it isn’t a surprise that cash transactions outweigh mortgage purchases,” said Durrani.

Many assume that Dubai’s property boom was driven mainly by premium segment sales but that wasn’t quite the case at all, corrected Knight Frank.

“The rate of growth in the luxury home segment of the market last year was 16.9% compared to 19.1% across the rest of the market. So the percentage increase was actually stronger in the mainstream market than it was in prime market,” shared Durrani.

He added that unlike previous property market cycles, more buyers today are purchasing properties to live in rather than using it for investment purposes.

Reality check #2: Dubai’s FDI is pretty diversified already 📊

The second most cited reason was that Dubai is fractionalising real estate to drive more FDI and diversify its FDI mix. But even that doesn’t completely tee up, especially when you consider the plausibility of execution.

“Why would an international investor sitting out of New York or Singapore want to buy a piece of a random condo unit in Downtown Dubai? How can they fully appreciate the value of that property as someone sitting from so far away?” questioned one Dubai startup founder.

“Unless that investor has lived in Dubai before and is well-acquainted with these neighbourhoods, he/she might find it difficult to understand what exactly they’re investing in. This is unique to real estate and isn’t quite the case with other asset classes like gold or bonds which may experience more success with fractional tokens,” he added requesting anonymity.

From an FDI diversification standpoint, the emirate’s FDI mix is also pretty spread out across sector and market.

According to official Dubai government statistics, the top two sectors are hotels & tourism and real estate which contribute 14% each to Dubai’s FDI mix, while the top two source countries are India and UK at 21.5% and 13.7% respectively. (See breakdown below.)

Dubai FDI capital by sector (2024)

Dubai FDI capital by country (2024)

Contrast that with Singapore, where its largest FDI sector, finance and insurance contributed 60.4% in FDI alone. The top five industries collectively made up 99.1% of total FDI inflows into Singapore.

When it comes to source country, the United States contributed nearly $50 billion or about 30% of Singapore’s total FDI of $191.56 billion in 2024. (See screenshots below.)

Singapore FDI capital by sector (2024)

Singapore FDI capital by country (2024)

Wait, so why are they doing this again? 🤔

So if Dubai’s real estate market isn’t suffering from illiquidity or a lack of mainstream demand, and the city’s FDI is well diversified, why are they going through all this effort to do this at all?

Intriguingly, the responses range quite widely across stakeholders — from lofty ideals of Gen Z financial inclusion to superficial vanity project. All of which don’t seem to support any underlying motivation around why any kind of technology (blockchain or otherwise) should be built in the first place — to solve an imminent problem.

There are also questions around market appetite and the potential implications on Dubai’s already skyrocketing property prices. Many of the rollout details are still fraught with scanty details.

Furthermore, Dubai’s patchy experience with real estate investment trusts (REITs) hasn’t displayed robust investor appetite for new asset classes in the sector as well.

The Dubai-listed Emirates REIT, one of the largest in the UAE, suffered declining asset valuations and high vacancies, eventually leading its share price to collapse during the COVID pandemic in 2020. Even today, trading liquidity remains low for the asset class.

Regardless, that hasn’t stopped Dubai’s DLD from advocating its new pet project. On Wednesday, Prypco, its UAE-licensed token trading platform partner sold out its second property in a “record-breaking time” of 1 minute and 58 seconds.

“This is the first time a title deed is tokenised…We're providing a new investment tool,” shared Dr Mahmoud AlBurai, Director of the Real Estate Policies and Innovation Department at Dubai Land Department (DLD) on an interview with local radio show, Dubai Eye 103.8.

“This is in alignment with our real estate strategy for 2033. We want to be the first choice for international investors. We want to go from 761 billion dirhams to 1 trillion dirhams by 2033. This is a new product where we enable small investors to invest in real estate with as little as 2,000 dirhams in the first stage,” he explained.

Dubai’s 2033 Real Estate Strategy & KPIs

Double real estate sector’s contribution to Dubai’s GDP to AED 73 billion

Increase homeownership rates to 33%

Grow real estate transactions by 70%

Raise market value to AED 1 trillion

Expand Dubai’s real estate portfolio 20x to AED 20 billion

Source: Government of Dubai

While multiple stakeholders have lauded Dubai’s front-footed approach to employing blockchain innovation at scale, its true impact and success is less certain. It’s also worth questioning how much real value-add this project will bring to the real estate market itself.

"Dubai deserves credit for embracing new technologies and transaction options. It will take time for investors to understand the structure and risk of this investment option,” said Stewart Kirkham, an independent real estate consultant in the GCC.

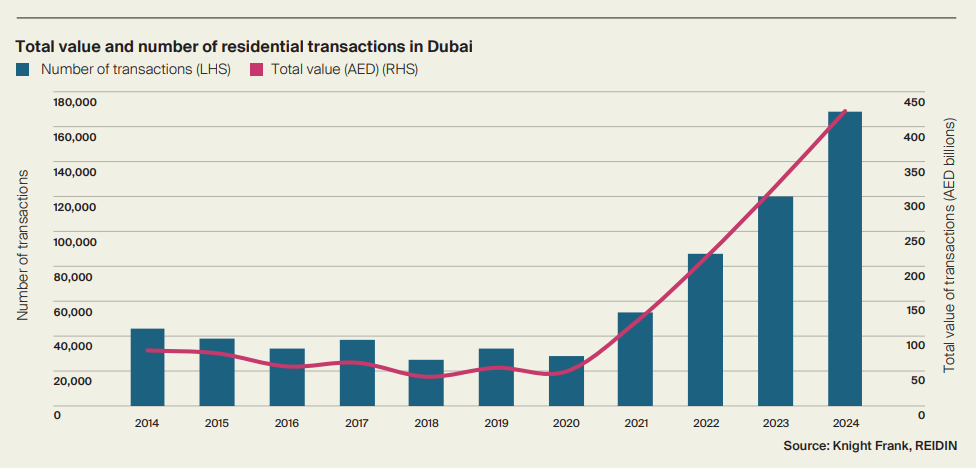

“Currently, many aspects of the real estate market are working well, which is only demonstrated by the strong performance and incredible results of the past few years," he added.

Dubai Land Department (DLD) and Virtual Assets Regulatory Authority (VARA) were contacted, but no response was received at the time of publishing this story.

Other reads! 🤓

Dubai's RWA tokenisation experiment has begun (Kristie’s Substack)

Dubai property rally closes in on pre-2008 record (Financial Times)

Dubai real estate prices likely to face double-digit fall after years of boom, Fitch says (Reuters)

Dubai Ruler’s $584 Million REIT IPO Surges In Debut (Bloomberg)

The Ins and Outs of Fractional Property Investing (Business Times)

The Blockchain Revolution: Making NYC Real Estate Accessible for $1,000 (Cointrust)