What Clearworld's data tells us about MENA startups in 2025

A TLDR version with some of my thoughts thrown in 💡

Some of you may have seen Clearworld publish its 2025 MENA Early Stage Handbook this morning :) I had a look and found some interesting data points. It certainly raises a lot more questions for the MENA VC/startup landscape moving forward.

Check out the full report here.

Meanwhile here’s a TLDR version :)

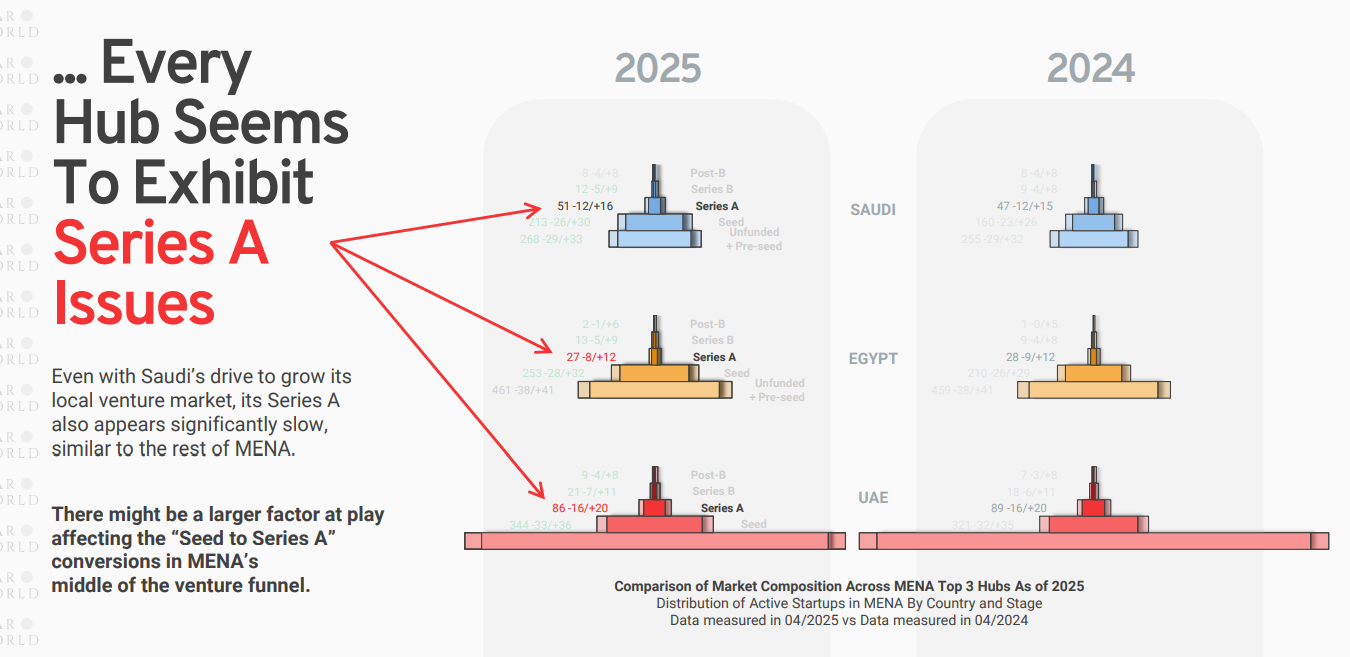

1. The number of Series A MENA startups remained unchanged in 2025 versus 2024

Clearworld doesn’t outline the reasons why Series A may be “stuck”, although one can easily guess. These are my personal hunches.

i) Series A founders are finding it difficult to raise Series B because MENA VCs are deploying less or taking longer to deploy, or are unwilling to lead.

ii) Series A rounds are getting extended by bridges/convertibles, so with longer runways they are not raising Series B as quickly (aka within a year)

Both of the above can apply to seed founders, who find themselves stuck and therefore and unable to “graduate” to Series A. However from my conversations with VCs/founders here, the funding gap in MENA tends to be in the Series B+ stages.

Clearworld anticipates that if this continues, 30% of MENA’s Series A startups could be written off by 2026 as the prospects of raising growth capital diminish.

2. There was a 30% jump in new AI companies but most of them were simply “rebranded” 👀

The chart above tracks the number of MENA companies going back to 2019 which “rebranded” themselves as AI companies in 2025. This created an artificial bump in new AI companies in MENA, which comes up to 332 firms in 2025 versus 256 firms in 2024.

More AI wrapper companies entering the pipeline… (Oops)

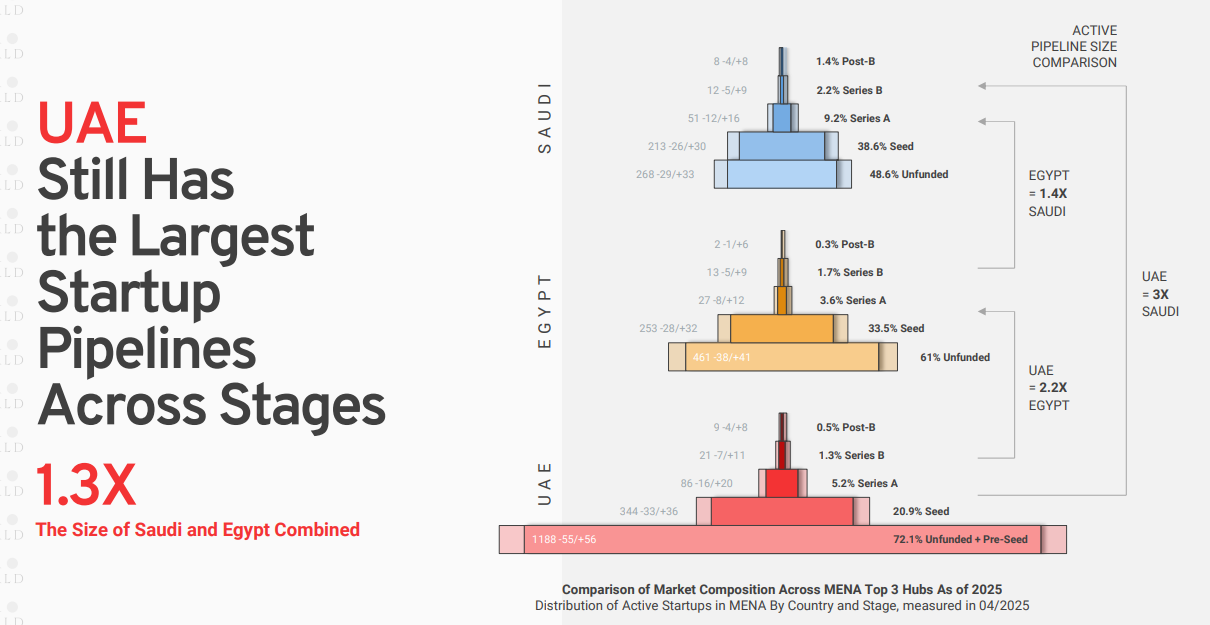

3. UAE is still the undisputed king of startup dealflow 👑

According to Clearworld, roughly half or 45.8% of all MENA startup dealflow comes from the UAE alone. Egypt and Saudi Arabia come in second and third, with dealflow market share of 21% and 15.4% respectively. This is from a total count of 3,600 active startups in 2025.

In other words, UAE has a startup pipeline of 1.3x the size of Saudi and Egypt combined. Saudi Arabia is displaying pipeline growth (even now) but it clearly still has quite a lot of catching up to do. UAE’s leadership can largely be attributed to its ability to attract talent and capital from across the region, which has been the case for several years now.

4. Crypto has a sizeable presence (No surprises here!) 🪙

Dubai has placed a lot of focus to turn itself into a global hub for crypto.

Setting up a virtual assets regulator (VARA) to create dedicated regulatory frameworks, fostering partnerships and events (TOKEN 2049), opening its doors to global crypto majors like Bybit, Binance, Chainalysis, OKX to set up HQs, and more recently, encouraging real asset tokenisation starting with real estate.

So it’s no wonder crypto founders are choosing to set up shop in the UAE. According to Clearworld, investors can expect to meet one crypto startup out of every 20, and twice as many if you filter out the non-tech folks.

5. Seed and Series A tickets, round sizes and valuations are still trending up 📈

Perhaps the juiciest of all — fundraising data. According to Clearworld, seed and Series A startups are still commanding pre-money valuations, tickets and round sizes displaying an “increasing” trend. You may refer to the table above.

Depending on how this data was captured, it is difficult to tell whether down rounds have happened already (or are baked into a convertible). If early-stage startups are extending their runways (as they should during challenging markets), it will be interesting to see how far they will still be able to command rising valuations in this environment.

Most of the global investors I’ve spoken with tend to flinch at MENA valuations, especially when they’re Saudi startups. Given the macro aversion towards VC and startups globally, I think the MENA startups which will be able to raise successfully will have to display compelling category leadership, show positive unit economics and/or target a global rather than a regional TAM.

What do you think about the data though? I’d love to hear your thoughts :)