ONE Championship's FY2023 results are out. Let's dive right in

P.S. It does not look pretty

It’s been a busy week for ONE Championship. On Monday (June 30), the Asian mixed martial arts (MMA) unicorn made a public announcement which raised a few curious eyebrows.

ONE Championship will officially shift its global production operations from Singapore to Bangkok, citing “increased output, logistical efficiency and growing scale of its weekly ONE Friday Fights”. Its investor relations, strategic planning and senior leadership team will continue to be housed in Singapore.

ONE’s co-founder and CEO, Chatri Sityodtong called it “a step forward” for the sports media property, revealing that its overall revenue for 2025 is approaching $200 million, up from $148 million last year.

But ONE’s 2024 financials had not even been filed yet.

On that very same day, ONE Championship quietly submitted a letter to Singapore’s Accounting and Corporate Regulatory Authority (Acra), requesting for a 60 day extension to file its numbers for 2024.

“The reason for this application is that our auditors require additional time to complete the audit due to resource constraints,” wrote Cai Yi Jin, also known as Jesley Chua, who serves as ONE’s director and chief financial officer.

Ernst & Young has been ONE’s auditor for many years.

Cai counter-proposed that ONE will hold its annual general meeting (AGM) no later than 29 August 2025 and file its annual return by 29 September 2025.

This is not the first time that ONE has generously rattled off its numbers in this way. If anything, it was meticulously timed.

Within 24 hours of that press release, a stream of personal announcements by various staff members at ONE began to make its way into the public domain. Layoffs were happening.

It is not known exactly how many people were affected, but sources have shared that cuts were made globally in marketing, editorial and PR teams in Singapore, the US, the Philippines and the UK.

This is not ONE’s first wave of layoffs. In fact, the Singapore-headquartered company has been steadily slashing headcount since the COVID pandemic in 2020, which struck its live events business and forced major delays on its US expansion plans.

Even though ONE managed to secure blue chip investors like Qatar Investment Authority (QIA) and Guggenheim Investments in December 2021, that $150 million fundraise eventually turned out to be its last major equity raise for a long time.

A curious news leak to Bloomberg last October stated that ONE raised an additional $50 million from QIA, but the firm’s latest filings suggest that it may not be a completely new round at all.

Beneath the surface, ONE was already trying to massage its mounting losses while executing on its grand ambitions to take on the Ultimate Fighting Championship (UFC) in the US and globally.

Their latest FY2023 report reveals a number of noteworthy developments.

1. ONE Championship is consolidating/striking off some of its entities and moving them to its Cayman entity, “Group One Holdings (Cayman) Limited”

This includes: i) ONE’s employee share option plans; ii) Equity stakes in ONE China Pte Ltd, ONE Championship, Inc (US entity) and ONE Championship Ltd (Thai entity); Dentsu Group’s 19.89% minority stake in ONE Esports which was disposed in October 2024.

This also involves the movement of related transactions with these same entities to the Cayman.

One key transaction was a FY2020 transaction made with its US entity, ONE Championship, Inc, where ONE sold its IP rights for a consideration of $400 million to itself. $200 million of it was settled in shares, while the other $200 million was settled in cash. (See below.)

In the latest FY2023 statement, $200 million from this same transaction appears to have been in the form of an promissory note or an IOU with all rights, title and interest related to it transferred to the Cayman entity in FY2023 (see below.)

ONE’s latest $50.5 million round raised in October 2024 involves ordinary shares, which were also issued to the Cayman entity. Ordinary shares are usually issued to early employees and convertible note holders, while preference shares tend to be issued to investors at a new capital raise.

2. Saurabh Mittal’s Mission Holdings is the ultimate holding company of ONE Championship?

Mission Holdings is an investment firm owned and run by Singapore-based Indian billionaire Saurabh Mittal, a co-founder of Indiabulls, a financial services and property conglomerate in India.

His investment firm, Mission Holdings is one of ONE’s earliest and largest shareholders, where Mittal continues to retain a board seat.

Other board members include Peak XV Partners’s managing partner, Shailendra Singh; QIA’s Abdulla Ali Al-Kuwari; and ONE’s Chatri Sityodtong and Teh Hua Fung.

According to ONE’s FY2023 statement, Mission Holdings Ltd became ONE’s immediate and ultimate holding company in 1 January 2022. A few months later in May 2022, Group One Holdings (Cayman) Limited was formed, making it ONE’s immediate holding company.

However the statement says that Mission Holdings remains the “ultimate holding company”, which hints at Mission’s continued close involvement and oversight at ONE Championship and its Cayman entity set up. (See below.)

3. ONE Championship was loss-making in FY2023

To set the scene, 2023 was a key year for ONE Championship.

This was the year ONE was making an aggressive push into North America, with its first US live event headlined by Demetrious Johnson vs. Adriano Moraes in Broomfield, Colorado (May 5).

ONE’s partnership with Amazon Prime also began that year, with ONE’s Prime Video Fight Nights streaming into North America’s primetime slots.

In Asia, ONE was ramping up the frequency of its fights with its weekly ONE Friday Fights in Lumpinee Bangkok.

Let’s take a look at some of the numbers.

ONE’s FY2023 figures:

Loss for the year: -$90 million (Losses up 46% on-year)

Revenue: $68 million (Grew 25.1% on-year)

Biggest expense came from marketing: $59.6 million

Second biggest expense was employees: $21.5 million

Net cash loss from operating activities: -$61.7 million

Cash and cash equivalents: $21.7 million

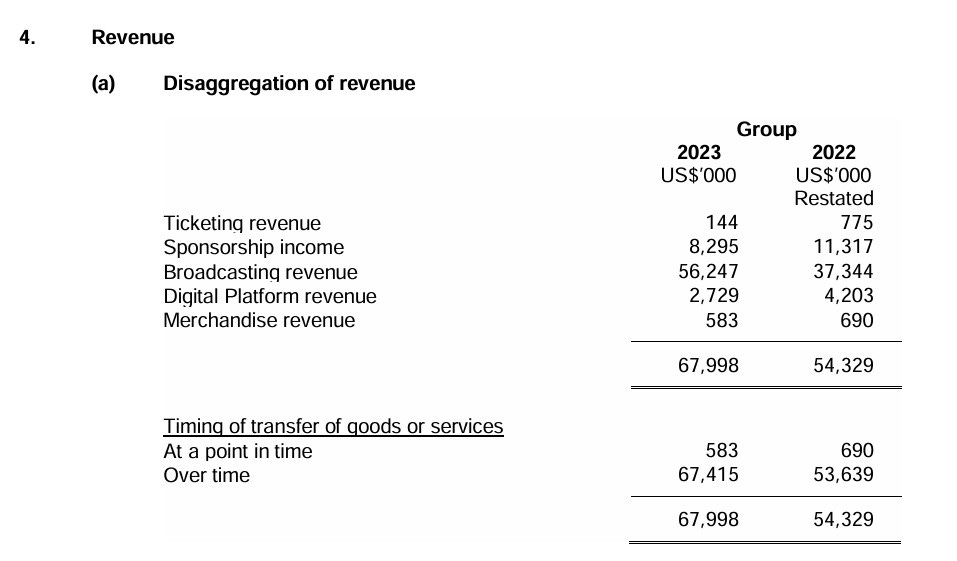

ONE’s revenue breakdown:

The bulk of ONE’s revenues continued to come from broadcasters (ie: Amazon Prime and others) which grew by roughly 50% to $56.2 million in FY2023. But even though ONE organised more events in 2023, ticketing revenue slipped that year to $144,000 from $775,000 the year before. (See below.)

ONE continues to recognise both cash and non-cash components for its broadcast and sponsorship revenue.

Other losses:

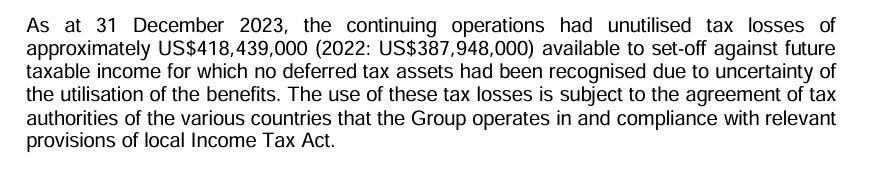

But in addition to these losses on ONE’s balance sheet, the company has yet to offset another $418.4 million of “untilised tax losses” against future taxable income. (See below.)

In other words, ONE already lost $418 million prior — this is money which it has the option to pay back in the form of less taxes later down the line, when it eventually turns profitable.

It is not clear how these were accrued and why it is this large.

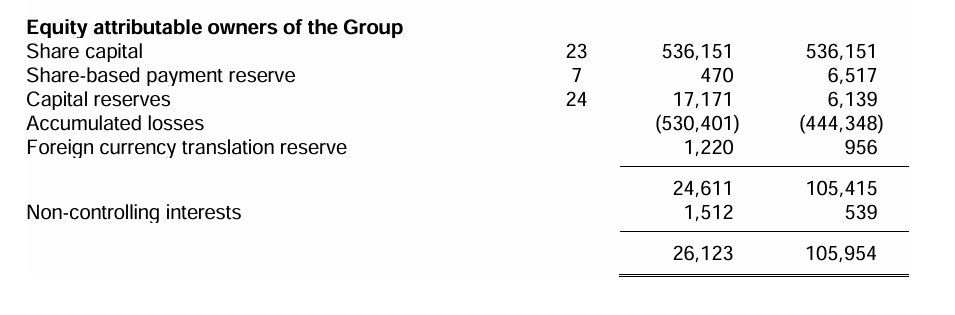

ONE Championship has raised about $536 million in share capital from investors like QIA, Peak XV Partners (formerly Sequoia Capital India), Guggenheim Investments, Temasek Holdings, Heliconia Capital, Mission Holdings and others.

However the firm also generated $530.4 million in accumulated losses. (See below.)

ONE Championship has been reached for a comment.