Newsletter #19: The illusion of founder-friendliness? War is business in the Middle East

This week's edition is about ethics in business 😇

In the Middle East, war is a business too ⚠️

It’s been a bewildering week in the Middle East.

After more than a week of aggressive crossfire between Iran and Israel, the IRGC invades Qatar airspace — one of the Middle East’s key conflict mediators — to fire missiles directly into the US Al Udeid Air Base in Doha. All of a sudden, a ceasefire happens, Trump declares “peace” and everyone is back out in the streets and BAU.

If anyone thinks this is going to last, you’ve got to be joking.

The irony of the Middle East conflict is that while it appears to deter risk-sensitive investors, war is exactly how politicians, bureaucrats and defense contractors make money.

It makes you wonder what will truly take to align the incentives for peace?

Israel makes money by melding the best of its military talent with its local VC/startup ecosystem to export to the rest of the world, the GCC signs mega defense contracts with the Americans in exchange for Big Tech, oil and gas.

There is always the possibility of much better, “more ethical” money-making opportunities in a peace time scenario, like how Wall Street dealmaker Ken Moelis suggests in a post-IRGC Iran:

(Moelis) characterized turbulence in the region as an opportunity for one of the most optimistic changes in the Gulf for a long time. He highlighted opportunities such as the potential impact of unlocking Iranian oil reserves and opening up the country’s labor market, assuming sanctions are lifted.

“All I hear about is what if the peace doesn’t hold…I haven’t heard one person say, ‘What if the 90 million population of highly educated motivated Iranians come into the market?’” (Source: Bloomberg)

But the market seems to suggest that we’re heading in the opposite direction — globally speaking at least.

OpenAI is now running a $200 million pilot programme with the US Department of Defense to develop “frontier AI capabilities to address critical national security challenges in warfighting and enterprise domains”.

Elsewhere:

Google Cloud is collaborating with Lockheed Martin on generative AI. Meta, too, changed its policies so that the military can use Llama AI. Big Tech stalwarts Amazon and Microsoft are all in. And Anthropic has partnered with Palantir to get Claude to the US military. (Source: Financial Times)

Silicon Valley VCs are also starting to invest in defense tech startups.

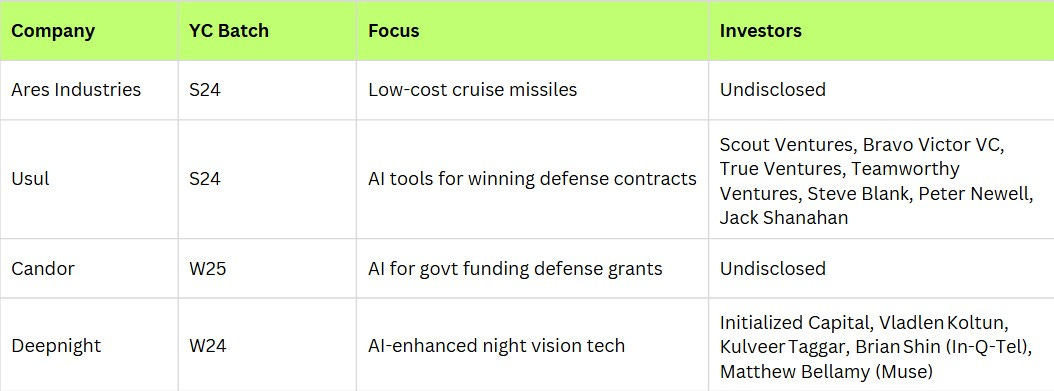

Y Combinator made an open call for more defense tech ahead of its Summer 2024 cohort, citing an opportunity to disrupt legacy defense contractors like NASA and Boeing. Since then at least 4 defense startups have graduated from the programme across hardware and software segments. (See below.)

Makes you wonder where all this is heading…😪

The illusion of founder-friendliness? 😇

Nowhere has this conversation seen the most evolution than in Southeast Asia, where VCs and founders are soul-searching about how and why they’ve ended up the way they have.

Since 2021-22, we’ve seen valuations plunge, IPO/M&A options narrow. If there are no exits, there is no DPI. No DPI means no liquidity. No liquidity means extra picky foreign investors. Lower FDI perpetuates the cycle, the cycle continues…

Founders feel the impact of this most. They’re the ones shouldering the burden of the business while forced to shift metrics according to the fickleness of macro market forces. “What happened to building a good, old-fashioned, profitable business?” they cry. No, that wasn’t what the VCs wanted to hear.

Now that the market has turned, some are questioning the entire industry itself. Does it really work in emerging markets at all?

For instance, why do we choose to have a preference share stack that is so debilitating for startup founders?

We’ve applied a system where VCs are protected because they get the pref shares they want, while founders are forced to raise a round every 12-18 months at pumped up valuations, with different terms, rights, and share of profits (above their own) with each new round, said Christopher Beselin, former CEO of Lazada Vietnam and founding partner of Endurance Capital Group.

Then imagine 5-10 layers of this, he said. It all becomes so complex that even the lawyers can’t solve it and makes the company nearly un-exitable. Not to mention the excessive dilution that some founders get at the end of the journey.

To put the blame squarely on VCs would be unfair — the onus is on founders too. Term sheets are financial instruments, not moral statements, argued Joseph Phua, former CEO of livestreaming platform 17Live. In other words, if you’re a founder, get in there with your eyes wide open.

But unfortunately this isn’t a line of argument that can carry you far in emerging markets where the path of entrepreneurship is generally hyped — and I do see this in the Middle East — where many founders don’t have significant exposure to operators outside of MENA and still rely on “experienced” investors for goodwill mentorship and advice.

One way to align incentives is to simply assign common shares to everyone, suggested Beselin. If the original intention of equity was to share up and downside, this would create a more healthy dynamic for investors and operators as equal shareholders and partners.

Your thoughts?

ICYMI:

VC Horror Stories: The Term Sheet Traps That Cost Founders Millions (New Economies Substack)

Founders fume over Malaysian VC’s term sheet (TechinAsia)

Asia's VC secondaries market isn't the lifeline investors hoped for (DealStreetAsia)

Interesting reads 🤓

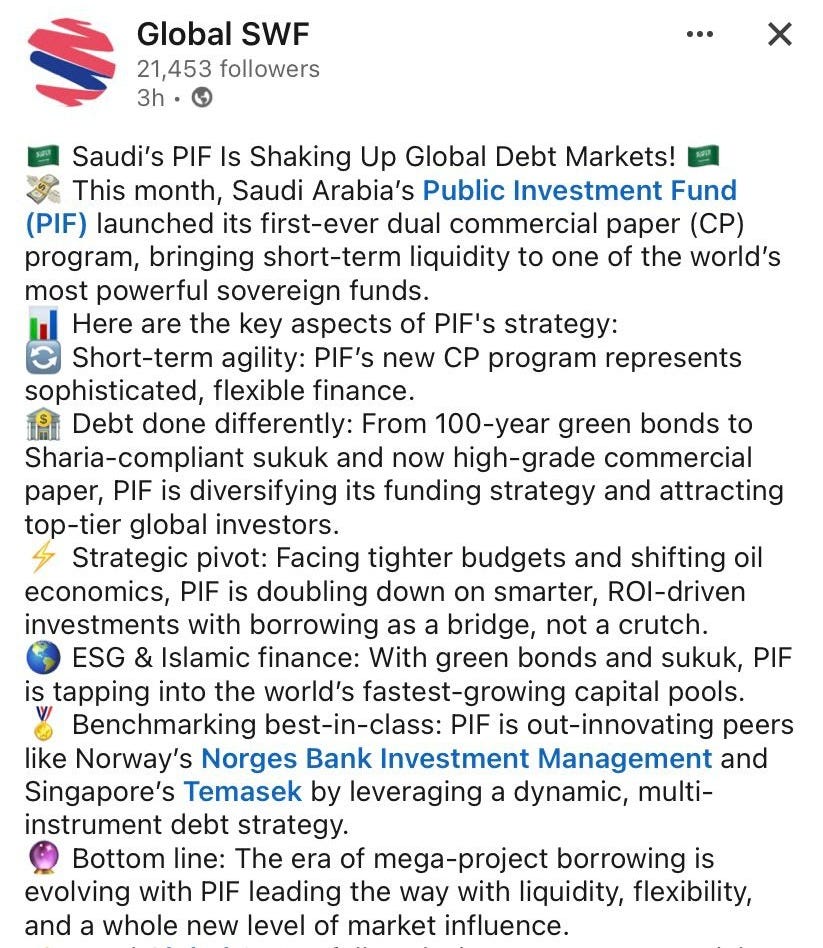

China’s Wealth Fund Pulls Plug on $1 Billion Private Equity Sale (Bloomberg)

Emerging markets defy investor gloom to outshine developed world (Financial Times)

US semiconductor maker Wolfspeed to file for bankruptcy (Financial Times)

Crypto coin for Russian shadow payments moves $9bn (Financial Times)

Inject equity in green industry not subsidies, EU tells capitals (Financial Times)

Indonesia wealth funds to double down on energy transition (Nikkei Asia)

Malaysia's Jelawang Capital names first five GPs for FoF programmes (DealStreetAsia)

Cow tech startup becomes New Zealand's latest unicorn in $100 million fundraise (Reuters)

New Zealand’s Xero to Buy Melio Payments in $2.5 Billion Deal (Bloomberg)

Dubai’s tech talent surge masks deeper challenges (TechinAsia)