Newsletter #18: SWFs in SEAsia vs Gulf; What's happening at ONE Championship?

Another action-packed week 🥊

Sovereign wealth fund strategies in SEAsia vs Gulf 💵

It is very interesting to trace the contours of SWF investment strategies across Asia and the Gulf as they seek to galvanise dollars and resources to secure their sovereign national interests.

Earlier this week, Indonesia’s Danantara Fund launched a $2.3 billion investment platform with Russia’s SWF, The Russian Direct Investment Fund (RDIF). It will invest in infrastructure, energy, food security, advanced manufacturing, with a priority on tech transfer, industrial upgrading, tech innovation.

Danantara’s move signals Indonesia’s interest in diversifying its investment sources beyond traditional partners like Singapore, Hong Kong, and China, which have been the leading contributors to Indonesia’s recent FDI growth. (Source: TechinAsia)

This is certainly suggestive of the way Indonesia’s President Prabowo has been courting a litany of state investors like Qatar’s QIA, USDFC, Australia’s Future Fund and Temasek.

Separately, the Philippines’ new SWF Maharlika Fund is employing a co-investment model to launch a suite of sector-specific funds, and recently secured a commitment from Thailand’s CP Group.

Unlike its wealthier Gulf and Singaporean SWF cousins which derive funds from oil & gas or budget surpluses, Indonesia and the Philippines have to count on raising monies from other SWFs/state funds to maximise seed capital, wrote DealStreetAsia.

And, this is an important shift: Sovereign credibility is no longer measured by the size of one’s coffers, but by how effectively they can syndicate global trust. (Source DealStreetAsia)

Ironically enough, “syndicating global trust” doesn’t actually make you…sovereign?

At least not technically?

One might even argue that it makes you more dependent but hey, the UAE’s handling of US and Chinese tech wasn’t any better…

The co-investment strategy has been well-employed by Gulf SWFs too, just in a slightly different way. GCC sovereigns like PIF are going directly to US Big Tech, mega asset allocators and operators (big boys).

In some cases they raise directly from them, like what Mubadala Capital did with TWG Capital two months ago, in exchange for access into key sectors and assets — be it sports media properties, GPU/chip supply chain, renewable energy etc.

Because the Gulf has sovereign oil & gas assets, they’re also in a position to raise debt by issuing bonds/sukkuks. These may be project-linked debt tied to mega infrastructure, real estate, energy projects (ie: NEOM, The Line).

One of the advantages of doing this is that Gulf SWFs can keep their cash reserves intact while putting debt monies to work on long-term investment projects. It also acts as a good hedge against potential oil price volatility.

What’s happening at ONE Championship?🥊

It’s been a long time since I’ve written on ONE Championship. The last story I wrote was for DealStreetAsia in December 2023. It was meant to be a two-part series, of which only one saw the light of day.

Since then, quite a lot has happened at ONE and with my move to Dubai in 2024, it’s been difficult to focus (!) But more crucially, it’s become incredibly difficult to verify sources and hearsay. As far as I can see, it’s noisier than it’s ever been.

For the uninitiated, ONE Championship is a mixed martial arts (MMA) sports media property from Singapore. They were last valued as a unicorn (>$1 billion) and backed by notable investors including Qatar Investment Authority (QIA), Temasek, Peak XV Partners (former Sequoia Capital India). All three are either active or former board members.

The company is led by a charismatic co-founder and CEO Chatri Sityodtong, whose awe-inspiring rags-to-riches story has been repeatedly questioned by hardcore MMA circles. But where it gets more problematic is ONE’s true state of financials.

In the past 14 years of its existence, ONE has burned through more than $550 million and produced very impressive headline figures along with a couple of balance sheet gymnastics thrown in as well…

All this has been well-documented by global MMA media as well as myself during my time at DealStreetAsia.

Naturally, this has raised a lot of questions around:

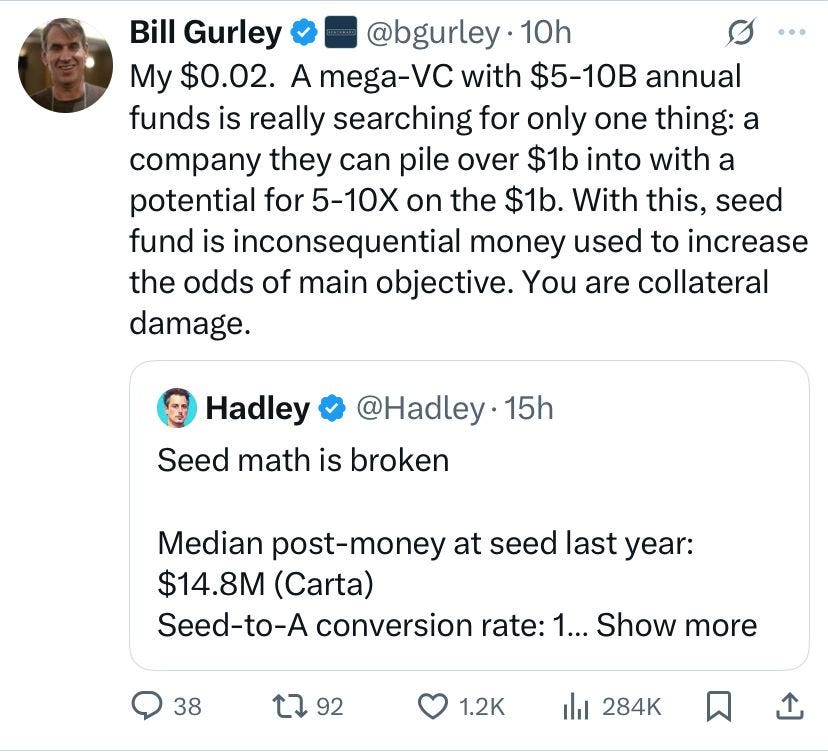

Due diligence processes: How do institutional investors like QIA and Temasek conduct DD? How thorough was it? Did they truly understand the business model of a sports media company and what makes it tick?

Accountability: How accountable are the likes of Temasek and Peak XV Partners for their apparent investment failures? What does it say for all the other investment failures that they may have committed? (I’m sure everyone’s portfolio has some bad eggs.)

For context, there are a few things worth noting about Southeast Asia’s ecosystem today.

Southeast Asia has matured to the point where fund managers and entrepreneurs are getting vocal and asking questions. It is not as cool to be FOMO investing anymore (ie: jumping into deals because XYZ Silicon Valley fund is leading it).

This investment involved sovereign (aka taxpayers) money. In this particular case, QIA and Temasek Holdings.

Anyway, a short story summarising the recent events at ONE Championship will follow in a separate post soon.

Interesting reads 🤓

Zombie fund era is pushing more VCs to take a career pivot (Pitchbook)

Chinese AI Companies Dodge U.S. Chip Curbs by Flying Suitcases of Hard Drives to Malaysia (WSJ)

Krutrim is a mirror of Bhavish Aggarwal’s broken dreams (The Morning Context)

Gulf states aim to provide the power to win the AI race (Semafor)

Saudi’s AI Firm Humain Forms Division Focused On Ads, Gaming (Bloomberg)

Hong Kong bourse seeks to woo Southeast Asia, Middle East firms for second listings (Reuters)

Mubadala-controlled Brazil bourse to start operations later than expected (Reuters)

Meituan’s Keeta will expand into UAE, Qatar and Kuwait, says founder Wang Xing (Momentum Works)

VinFast faces bumpy ride in SE Asia amid mounting losses, stiffer competition (DealStreetAsia)

Dubai's Aqua Bridge Holding sole bidder for embattled eFishery (DealStreetAsia)

‘Amazon of Africa’ Jumia fights to rebuild investor trust (Financial Times)

One championship is one of the best long cons I've ever seen