Interesting reads this week! #2

More eFishery founder mess, Qatar's FoF bets and more :)

eFishery’s founder seeks a lifebuoy…from the press?

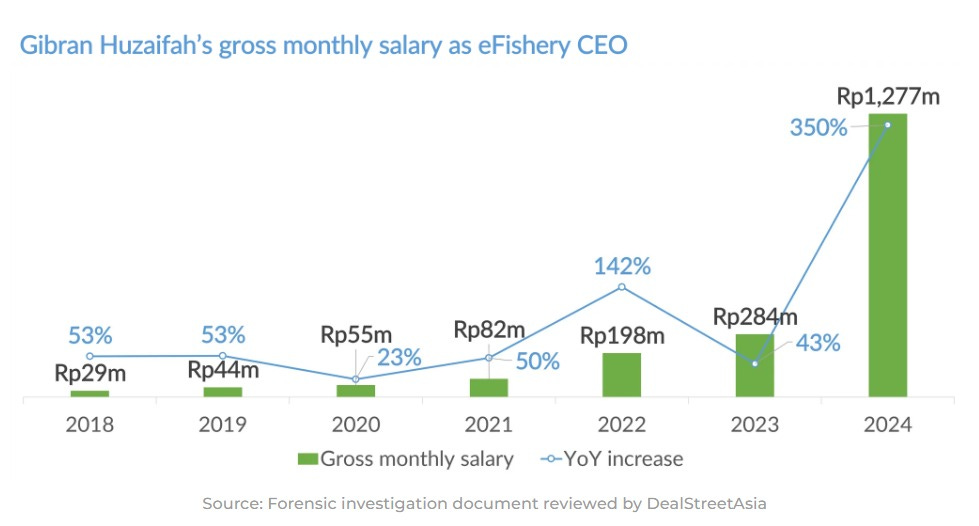

I mean what can I say. Southeast Asia media is having an absolute field day with this story. And they’re out for blood! Nevermind the embarrassment of round-tripping funds, keeping 2 books behind investor backs and then corralling all your staff members to get in on this game of charades. It seems that eFishery’s founder and ex-CEO, Gibran Huzaifah paid himself a very pretty pay package too. (See image below.) Based on his last 2024 drawn salary, he was taking home US$76,568 per month. In Indonesia!!! *faints*

Lots of questions here. 1) Does this figure include certain allowances that was part of his monthly salary like housing, car, insurance? 2) Did eFishery have a renumeration committee? If they did, how did this get passed and why? If they didn’t, how could a unicorn not have one?

On top of the salaries and bonuses, eFishery entered into a share buyback agreement with Gibran and Chrisna in August 2023, under which the company paid each of them $999,999.11 in consideration for the repurchase of 79,423 ordinary shares. The transaction took place shortly after the completion of eFishery’s Series D round in July, which valued the company at $1.35 billion and set the price for its preference shares at $14.39 apiece. (Source: DealStreetAsia)

eFishery, as you know, raised a very sizeable $108 million institutional round in 2023 led by Abu Dhabi sovereign G42. Other investors who joined include SoftBank Vision Fund II, Temasek, Northstar, 500 Southeast Asia and many others.

The past week must have created an absolute furore, because Huzaifah finally decided break his silence to clear his name with the local press. He denies the claim.

“That amount is untrue – I don’t know where they got the data from,” he tells Tech in Asia.

Well, well. Let’s see what comes up next.

ICYMI:

eFishery co-founders could face SG police investigation over alleged $253m losses (DealStreetAsia)

Gibran Huzaifah addresses eFishery fraud scandal for the first time (TechinAsia)

SoftBank, Temasek among eFishery investors facing near wipeout (Bloomberg)

EFishery ex-CEO calls billion-rupiah salary claim ‘untrue’ (TechinAsia)

Qatar’s $1b fund-of-funds is out and actively deploying

It’s been roughly a year since Qatar Investment Authority (QIA) announced their $1b fund of funds (FoF) programme and they’ve been busy. Here are the names they’ve deployed into so far:

B Capital (Global, multi-stage)

Deerfield (Healthcare)

Rasmal Ventures (MENA, multi-stage)

UTOPIA (Africa/Southeast Asia, impact-focused)

Builders VC (Early-stage, traditional industries)

Human Capital (Multi-stage, recruitment/talent-focused)

QIA is in the stage of analysing another 8 more VC firms to invest in, so expect more announcements soon.

Qatar is an interesting one because they were previously considered a little “late to the game” when it comes to jumping to the VC bandwagon in the Middle East. Because of this, most GPs have tended to flock to Abu Dhabi, and then more recently, Riyadh for fundraising.

But these days, some of the small (and rich) nations are beginning to come out of the woodwork. Oman Investment Authority (OIA), which runs an OMR 2 billion (US$5.2 billion) Oman Future Fund (note: as of 2023), announced its investment in Golden Gate Ventures’s $100m MENA fund this week as well.

Other reads:

FBI accuses North Korean-backed hackers of stealing $1.5 billion in crypto from Dubai-based firm (Associated Press)

Why scientists are sceptical about Microsoft’s Majorana claims (The Morning Context)

Chinese rivals to Musk's Starlink accelerate race to dominate satellite internet (Reuters)

Telio shuts, Tiki stumbles: Is VNG's e-commerce dream unravelling (DealStreetAsia)

Indonesia's new sovereign fund will run with commercial mindset, official says (Reuters)

Horizon Quantum Computing Plans to Go Public. How It’s Different From Peers (Barron’s)

Analysis: This Israeli investor can’t wait for a Saudi-Israel peace deal (Semafor)

Join Dubai, Abu Dhabi stock exchanges to drive investments - Egyptian billionaire Naguib Sawiris (Zawya)