APAC & Middle East startups have larger teams, distribute less ESOP than US peers

Carta's first report for the region reveals key insights 💡

Asia Pacific (APAC) and Middle East (ME) startups hire more and distribute less employee shares than their US peers, according to a report by US fund and equity management firm Carta.

The report featured data from Carta’s internal database of fund managers and startups from 2019 to 2024.

The findings reflect a maturity gap between the US and emerging tech ecosystems, but also raises important questions about the venture capital and startup industry in developing economies like Southeast Asia and the Middle East.

Why do APAC and ME startups have larger teams?

Depending on the funding stage, APAC and ME startups can have anything from +20% to double the headcount of their American counterparts.

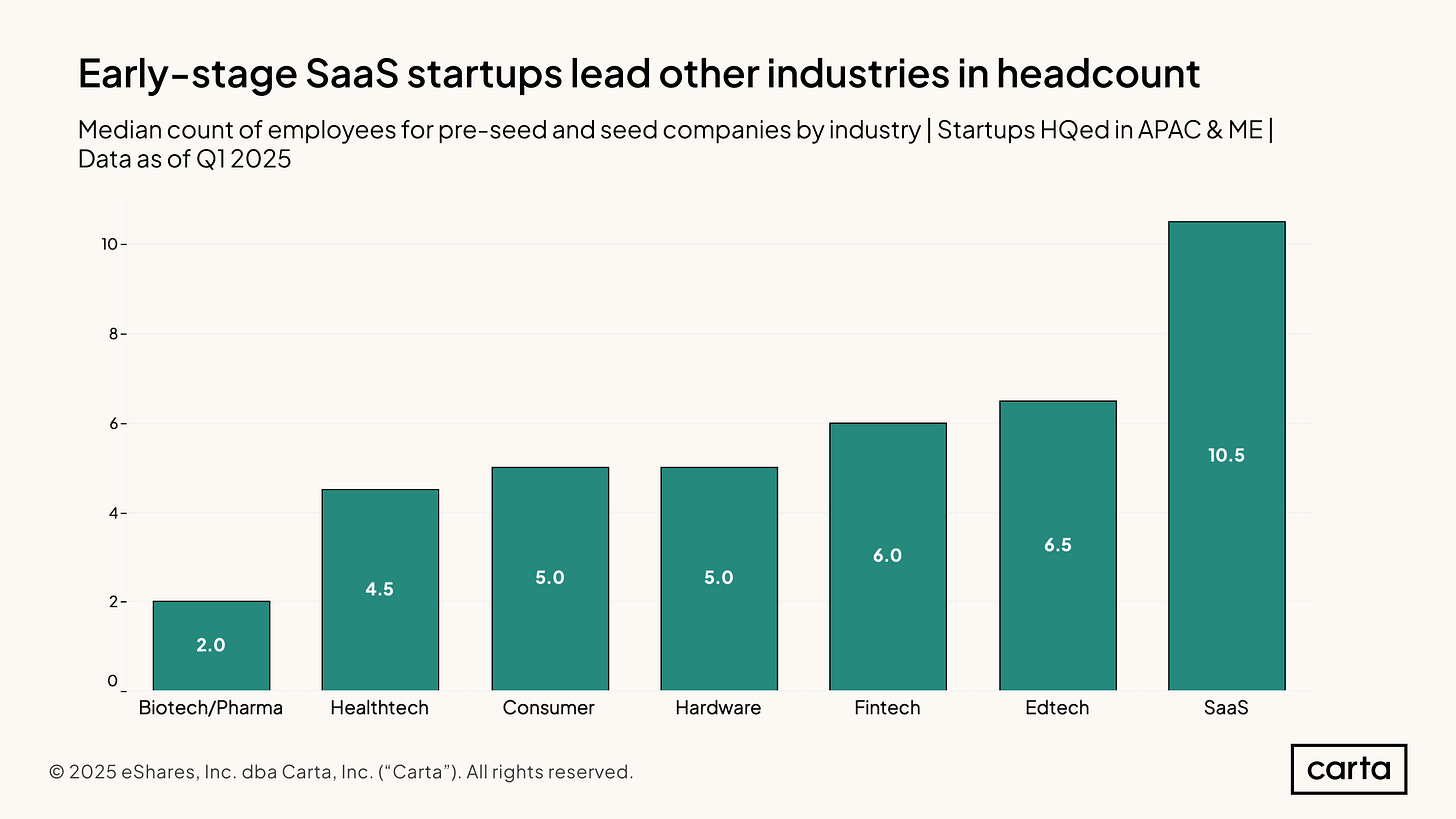

Ironically, software companies – well-known for their lean business models and wide operating margins – had the largest teams across all sectors. APAC and ME software firms had a median count of 10.5 employees versus 6.5 for edtech and 2 for biotech/pharma sectors, Carta’s data showed.

However, it’s worth highlighting that the analysis of the data should be contextualised for the 2019-2024 period, which represented the peak years of US Federal Reserve’s quantitative easing exercise. This led to massive inflows of foreign capital into APAC and ME, which may have incentivised a hiring spurt.

At the same time, the demands of scaling a software firm can also be quite different across markets. Selling and servicing SaaS has always required more people in APAC and MENA than in the Americas, said Bhavik Vashi, managing director for APAC and ME for Carta.

"Because of the nature of your customer being so diverse across these regions, speaking many different languages, being located physically in different places, coming from different cultural norms. You wouldn’t want to expect different levels of service relative to what they're paying you. As a provider, there isn’t a single person who can cater to all of those various needs,” explained Vashi on The Upside Podcast.

The comparatively cheaper labour available in APAC and ME also lowers cost hurdles for startup founders, leading to slightly larger teams. It also impacts the unit economics of labour for these businesses.

“It's not like SaaS (in APAC and ME) is priced at 50% of what it is in the US. But let's say SaaS is priced at 80% of what it is in the US…depending on how your blended labour cost is across different regions, it could be as low as 50%. So there's an arbitrage that allows you to have more people. And if that is what your customer wants then as a business leader, it’s an easy trade,” Vashi explained.

The bigger question moving forward is whether AI might radically transform the size of future startups and hiring patterns across the region.

OpenAI’s Sam Altman is already predicting a future where the idea of a “one-man $1 billion dollar company” is very much within reach. Rising inflation, macro uncertainties and a cooler fundraising market may also lead founders to think about hiring a little differently.

Carta’s data already hints at early signs of a hiring contraction – the ratio of new hires to departures have fallen to 2020 levels, suggesting that founders across the region are responding to market changes. (See chart below.)

Less stock options for APAC & ME startup employees? 🙁

APAC and ME startups also distribute less employee stock options (ESOPs) compared to US firms, according to Carta’s data.

Depending on the funding round, there can be a roughly 3-6 percentage point difference with US firms sometimes setting aside as much as 17.6% of company stock for early employees.

US firms also tend to increase their ESOP pool as it progresses through funding rounds. This isn’t the case for APAC and ME firms, where ESOP pools flatline as companies grow. (See chart below.)

There are various explanations for this. One is the lack of successful cash exits for early employees in APAC and ME; another is employee preference for cash over stock.

As a case in point, Australia and New Zealand (ANZ) firms tend to have slightly larger ESOP pools than their Asian and Middle Eastern counterparts, which is likely because these are more developed markets with homegrown unicorns like Canva, Xero and Atlassian as success stories.

“ANZ has a handful of companies which have proven this and recycled that capital back into venture through the Airtrees, Square Pegs and Blackbirds. They’ve also recycled that talent back through the ecosystem as well through advisory, angel, operating partner roles and even starting new startups. You can argue that’s starting to happen in Southeast Asia, but this is one of the fundamental areas that still needs to be unlocked here,” shared Vashi.

The lack of liquidity in secondaries markets in APAC and ME also means that it’s generally more challenging for shareholders to take cash off the table, further reinforcing the perception that cash is still king in these still-nascent VC ecosystems.

For extra reading:

What AI experts want from their employers (G42 & Semafor)

State of ESOPs in Asia 2024 (Saison Capital, XA Network, Carta)